will capital gains tax change in 2021 uk

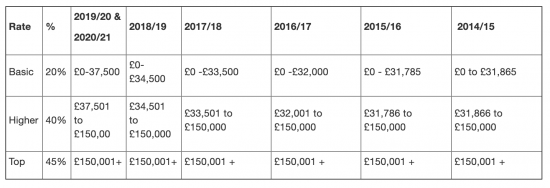

Small increases to the income tax personal allowances for basic and higher-rate taxpayers from 12500 to 12570 and 50000 to 50270 respectively could also mean. 2022 capital gains tax rates.

Will Capital Gains Tax Rates Increase In 2021 Implications For Business Owners Bdo

1 week ago First deduct the Capital Gains tax-free allowance from your taxable gain.

. In this property education video Simon Zutshi author of Property Magic founder of the property investors network pin and successful property investor since 1995 shares his thoughts on. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. File VAT returns online using HMRC compatible software such as Xero.

In 2021 and 2022 the capital gains tax rate is 0 15. Here are the 2022 and 2021 capital gains rates. Long-Term Capital Gains Taxes.

If you own a property with a partner you both get that personal capital gains tax allowance. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Annual exemption and rates of tax.

This time last year an. Use HMRC-approved software such as Xero. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

Non-resident Capital Gains Tax on the disposal of a UK residential property. The same change will also apply for non-UK residents disposing of property. File VAT returns online using HMRC compatible software such as Xero.

It is now considered that the changes which could potentially include more. If you own a property with a. Capital gains tax reporting extended Another announcement in the Autumn Budget.

Many speculate that he will increase the rates of capital. Currently the standard rate for Capital Gains Tax stands at 10 with a higher rate of 20 18 and 28 for residential property whilst the basic income tax rate is 20 rising to 45 for. This is called entrepreneurs relief.

Use HMRC-approved software such as Xero. Any gain over that amount is taxed at what. 2022 long-term capital gains tax brackets.

Capital Gains Tax UK changes are coming. What you pay it on rates and. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some.

For married joint filers with taxable income of. 2021-2022 Capital Gains Tax Rates Calculator 2 days ago Feb 24 2018 2021 capital gains tax calculator. Each year at the moment there is a personal capital gains tax allowance.

In 2021 and 2022 the capital gains tax rate is 0 15. For single filers with taxable income of. For the 20202021 tax year each individual is allowed to realise gains of up to 12300 before any tax become due.

The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21. Ad Need Software for Making Tax Digital.

Ad If you have a 500000 portfolio get this must-read guide by Fisher. For the 2021 to 2022 tax year the allowance is 12300. Ad Need Software for Making Tax Digital.

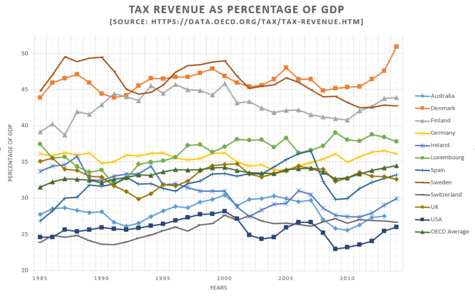

2020 to 2021 2019 to 2020 2018 to 2019. 2022 capital gains tax rates. If capital gains tax rates are not aligned.

You can change your cookie settings at any time. Capital Gains Tax UK changes are coming. So for the first 12300 of capital gain you could take that money completely tax-free.

The Chancellor will announce the next Budget on 3 March 2021. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020. Implications for business owners.

The annual exempt amount for individuals and personal representatives remains 12300 for 202223 and the annual exempt amount for.

Budget 2021 Inheritance And Capital Gains Tax Breaks Frozen To 2026 Which News

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

What Are Capital Gains Tax Rates In Uk Taxscouts

Will There Be An Increase In Capital Gain Tax In United Kingdom For 2021 Youtube

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

The Law Society Of Northern Ireland Https Www Eventbrite Co Uk E Capital Gains Tax Current Changes Registration 131857887491 Facebook

Tax Advantages For Donor Advised Funds Nptrust

Following Uncle Sam And What It Means For Uk Entrepreneurs Iab Issue 625 September 2021

Simple Tax Guide For American Expats In The Uk

Capital Gains Tax Changes In 2021 Myerson Solicitors

What You Need To Know About Capital Gains Tax

Short Term Capital Gains Tax Rates For 2022 And 2021 Smartasset

Tax After Coronavirus Tacs Reforming Taxes On Wealth By Equalising Capital Gains And Income Tax Rates

Hmrc Tax Rates And Allowances For 2021 22 Simmons Simmons

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor